[ad_1]

Mablink and ProfoundBio both claim to have modular linkers that can be paired with other payloads. These payloads, experts say, will drive the next wave of ADC innovation. Most approved and late-stage ADCs use only a handful of cytotoxics: those with proven potency and conjugation-friendly functional groups, such as amines or thiols. The main categories are microtubule inhibitors (such as the auristatin derivatives MMAE and MMAF) and DNA-damaging agents (topoisomerase inhibitors, calicheamicins and pyrrolobenzodiazepines).

Rapid advances in linker technology, including their ability to enhance stability and mask hydrophobicity, are expanding the range of payloads. This is good news, since having too many ADCs carrying the same payload could accelerate drug resistance. Scientists are still unpicking a range of possible mechanisms for ADC resistance, including payload resistance, downregulated antigen expression and changes to pathways that traffic therapies into cells.

“We want to unlock payloads that haven’t previously been used,” says Dominik Schumacher, CEO at Munich, Germany-based Tubulis. The company’s P5 conjugation platform uses branched polyethylene glycol phosphonamidates to efficiently conjugate hydrophobic payloads in a stable, homogenous fashion across a range of DARs. It attracted $22.75 million up front in April 2023 from Bristol Myers Squibb, seeking to develop solid-tumor ADCs with topoisomerase inhibitors. Tubulis’s second platform, Tub-tag, uses tubulin tyrosine ligase to tweak the antibody component while accommodating various payloads and DARs. The idea behind both technologies is to “enable flexible ADC design to suit the target and clinical profile in question,” says Schumacher. He would not reveal which payloads Tubulis is testing in its own solid tumor-focused assets, but says the approach enables payloads to be conjugated in their native form and thereby maintain full potency. Chemically modifying payloads to facilitate conjugation, as occurs in many ADCs, can reduce their potency.

Elsewhere, protein degraders are attracting interest as ADC payloads. Bristol Myers Squibb in October 2023 paid $100 million up front to South Korea’s Orum Therapeutics for a phase 1-ready CD33-targeting ADC carrying a small molecule designed to degrade the GSPT-1 (G1 to S phase transition-1) protein. The candidate will be tested in acute myeloid leukemia and myelodysplastic syndromes. Orum’s lead in-house ADC is in phase 1 trials for breast cancer. Merck & Co. followed suit in December 2023 with a smaller, $10-million up-front payment to C4 Therapeutics for degrader payloads that it will conjugate to in-house antibodies. Merck will develop and commercialize the resulting ‘degrader–antibody conjugates’.

Prague-based Sotio Biotech is working on an anthracycline-based payload using technology licensed from Boehringer Ingelheim-owned NBE Therapeutics in Basel, Switzerland. Phase 1/2 trials of a claudin18.2-targeting ADC using NBE’s sortase-mediated conjugation platform are ongoing in gastric and pancreatic cancer. Sotio also promised up to $740 million to Lonza-owned Synaffix in October 2023 for rights to use its ADC technologies to develop three solid-tumor ADCs.

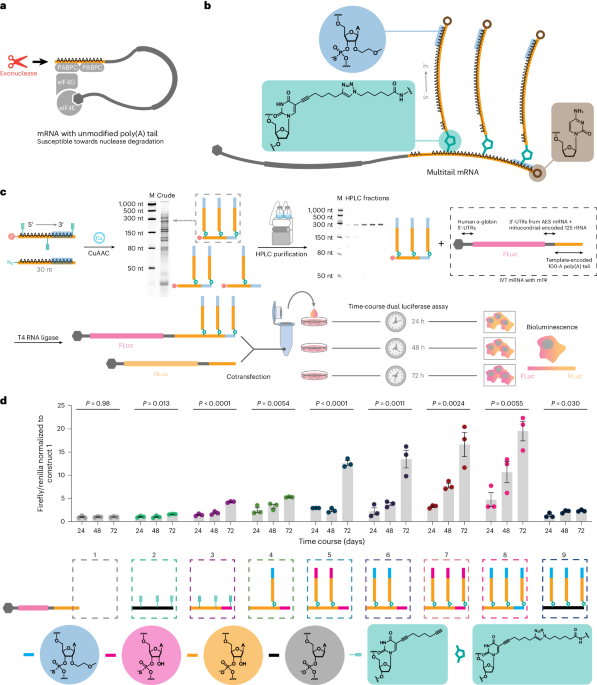

Other drug classes may also benefit from antibodies’ targeting prowess. Oligonucleotide-conjugated antibodies, already used for protein diagnostics, offer another twist on ADCs, which may gain further traction as RNA-based therapies — including small interfering RNAs and antisense oligonucleotides — continue to grow. Preclinical work shows immune-stimulating antibody conjugates using payloads such as Toll-like receptors can trigger antitumor T cell responses; there are also efforts to tag radionuclides (radiation-emitting isotopes) onto antibodies to create precision radiation therapy.

First-generation radionuclide–antibody conjugates like GlaxoSmithKline’s Bexxar (iodine-131 tositumomab) failed to get off the ground, in part because of toxicity concerns. Yet targeted radiotherapy — using peptides or other targeting agents to deliver precision radiation to tumors — is seeing a resurgence, as evidenced by Bristol Myers Squibb’s $4.1-billion acquisition of RayzeBio in December 2023. RayzeBio’s lead program builds on Novartis’s Lutathera (lutetium-177 dotatate), which uses a somatostatin analog peptide to deliver a radionuclide to somatostatin receptor-positive gastroenteropancreatic neuroendocrine tumors and was approved in 2018.

Maqvi News #Maqvi #Maqvinews #Maqvi_news #Maqvi#News #info@maqvi.com

[ad_2]

Source link